Today in this Guide we will discus about NSDL to CDSL Shares Transfer Online. if you have Demat Account with NSDL Depositary then you can Transfer your Shares and Mutual Funds Both from NSDL to CDSL Account.

What is NSDL or CDSL ?

NSDL is the short form of National Securities Depository Limited. It is an Indian central securities fund that permits electronic store-house and business of mortgages. CDSL is the short form of Central Depository Services Limited.

As we all know, all the discounted popular brokers in India are above CDSL and all the full flash brokers of banking are above NSDL.

NSDL to CDSL Shares Transfer Method

As we know normally there are three types of transfers :-

- CDSL to CDSL fund transfer.

- NSDL to NSDL fund transfer.

- The process of transferring funds from NSDL to CDSL is complicated as compared to the CDSL.

Because NSDL provides very few options for share transfer as compared to the CDSL. So here we have simply two methods to transfer the share :

- Online Method – In the online method, you have to use the option through speed e-service of NSDL and keep in mind that you also have to get a digital signature and a smart card also to be made and if we talk about its costing, It costs more than Rs 1800, so it is a very expensive and complicated process.

- Offline Method – It involves manual process and here the person has to give physical delivery instructions through the broker.

Online Method for NSDL to CDSL Shares Transfer Steps

Step 1 – First of all you will have to go to NSDL’s e-service.

Step 2 – After that you will get an option Speed-e, you will have to click on it and sign up and if you do not have an account then go to New User Registration and click on the option of Speed-e.

Step 2.1 – Here Signup can be done in two ways. One can create a normal password and sign in, but a person cannot transfer shares by using it. You can only check your demat account report, how many shares are left in it, what is their value, only this can be checked.

Step 3 – But if you want to transfer shares then you will see two options on the speed-e page. You will have to use a smart card user option and this is a complicated process.

Step 4 – In this you have to download and attach two application forms and power of attorney then you have to sign and send it to the broker, then the broker approves it.

Step 5 – The DP will verify the details and then assign a user-ID which helps to receive the smart card kit, Digital Signature Certificate (DSC), and Personal Identification Number (PIN).

Step 6 – You have to install the smart card kit on the computer with the user-ID, DSC and PIN.

Step 7 – The securities can then be committed to the required beneficiary by using the inter-depository module.

Offline Method for NSDL to CDSL Shares Transfer Online

To transfer shares from CDSL to NSDL, you have to follow the given points step by step.

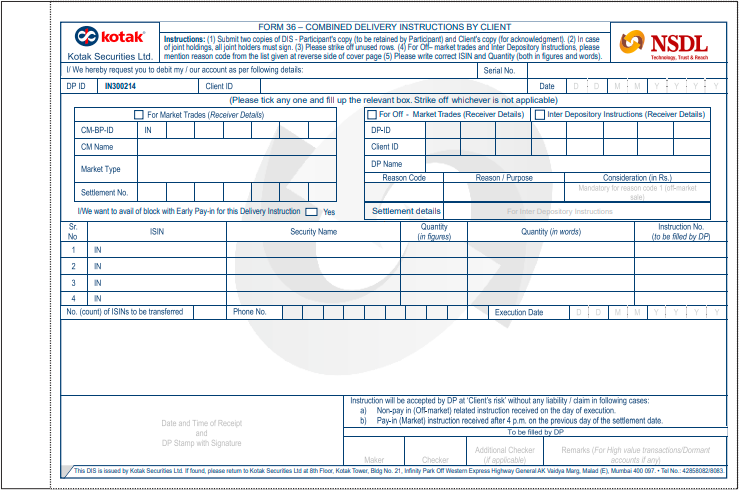

- Depository Information Slip (DIS) has to be filled by using the current pamphlet or can obtain one from the broker/DP.

- You have to ensure by choosing inter-depository transfer.

- You must select Off-Market as the Market Type

- You need to enter the Customer ID and DP ID of the beneficiary

- You need to enter the required information for the transferable stock including ISIN, security name and quantity.

- DIS will have to be signed.

- You have to send DIS to your depository participant or broker.

The depository participant or broker will finalize the transfer, within 2 to 5 business days.

Conclusion

You should know that you can transfer shares between CDSL and NSDL demat accounts.Inspite of, it is requisite to select “Inter-Depository” as the transfer mechanism while transferring shares across depository locations.It is important to note that the securities you are transferring must be both depository and dematerialized. So Hope now all doubts regarding the NSDL to CDSL Shares Transfer has been cleared.